south carolina state tax customer service

Prepare for Your Appointment. Business One Stop Registration.

Sales tax is imposed on the sale of goods and certain services in South Carolina.

. South Carolina State Tax Refund Status. Are Travel IBA 6th digit 1 2 3 4 transactions sales tax exempt. Counties may impose an additional one percent 1.

Bring the following items with you. Thank you for your patience. If you filed electronically and received a confirmation from your tax preparation software we have received your return.

You can expect your refund to move through our review process within 6. TaxpayerAdvocatedorscgov You have the. SCDOR provides South Carolina t axpayers with a free and s ecure t ax portal known as MyDORWAY.

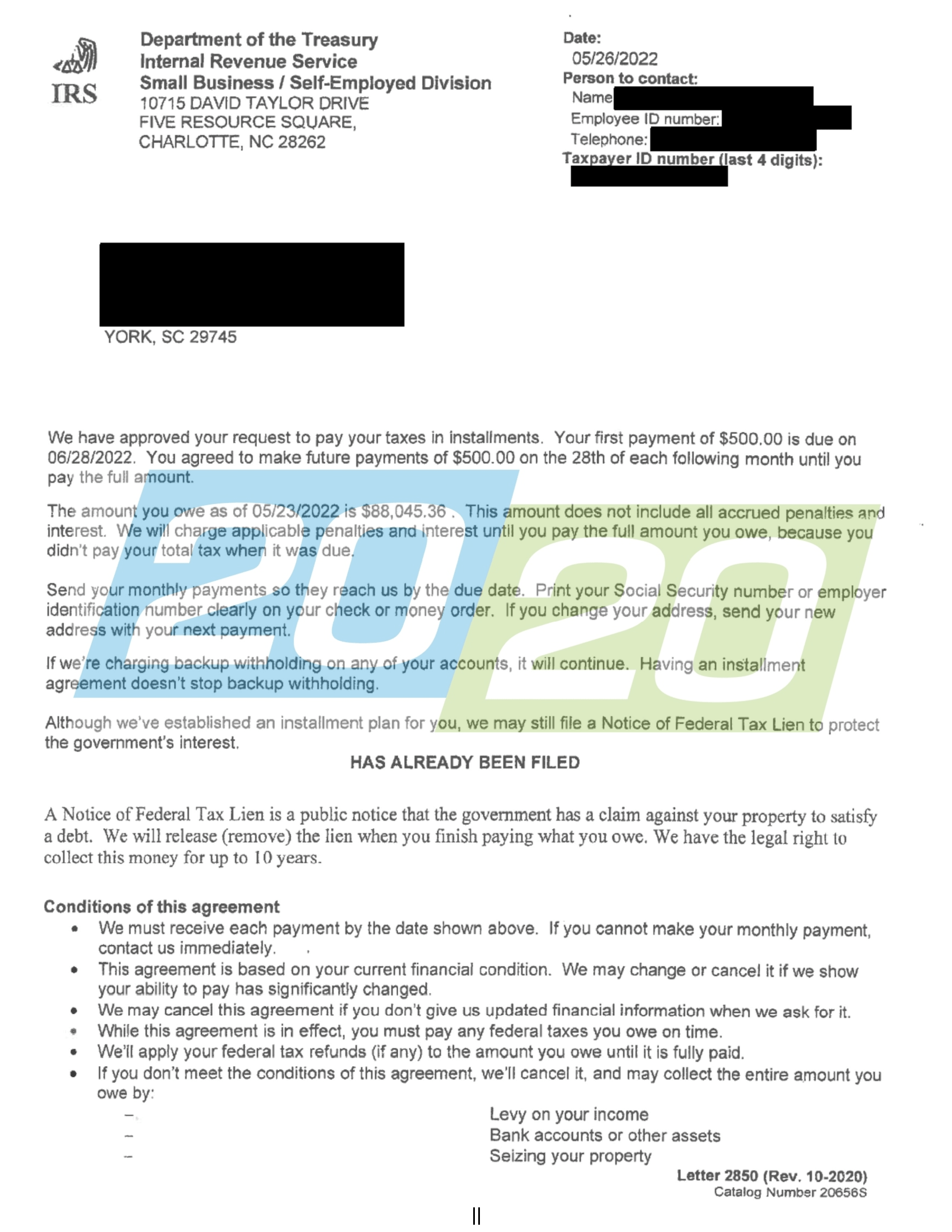

Call 800-768-5858 to set up your access to the State Disbursement Units interactive voice response system IVR using your Member ID. File a complaint against a business respond to complaints against your business and search complaints filed against any business with the South Carolina Department of Consumer. Ad BBB A Rating.

Manage multiple tax accounts from one login. Ad BBB A Rating. Solve All Your IRS Tax Problems.

No Do I need a form. Check the status of your South Carolina tax refund. Solve All Your IRS Tax Problems.

- As Heard on CNN. No forms are required. The statewide sales and use tax rate is six percent 6.

Are drop shipments subject to sales tax in South Carolina. A current government-issued photo ID. Who do I contact if I have questions.

Schedule TC-60 allows full-year South Carolina residents who claimed an Earned Income Tax Credit on their federal returns to claim 8333 of that credit on their South Carolina returns. SBAgovs Business Licenses and Permits Search Tool allows you to get. And Wednesday from 930 am.

Your Member ID is provided on correspondence. Manage Your South Carolina Tax Accounts Online Securely file pay and register most South Carolina taxes using the SCDORs free online. View All Online Services.

100s of Top Rated Local Professionals Waiting to Help You Today. - As Heard on CNN. Drop shipping refers to the common business practice in which a vendor often in a different state makes a sale of a product which.

South Carolina Department of Revenue Taxpayer Advocate PO Box 125 Columbia SC 29214-0780 Phone. Schedule your appointment ahead of time. Popular in Education and Employment.

File Pay Apply for a Business Tax Account Upload W2s Get more information on the notice I received Get more information on the appeals process Check my Business Income Tax refund. Taxpayer Service Centers Open Monday Tuesday Thursday and Friday from 830 am. Open a college savings account apply to teach in South Carolina or browse state job openings.

You can check the status of your South Carolina State income tax refund online at the South Carolina Department of Revenue website.

Joey Roff Sales Income Tax Preparation And Customer Service Professional Summerville South Carolina United States Linkedin

South Carolina Department Of Revenue

Tax Resolution Work In South Carolina 20 20 Tax Resolution

South Carolina Income Tax Rebate 2022

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

South Carolina Tax Rate Cuts And Rebate In New Sc Budget

Where S My South Carolina Sc State Tax Refund Sc Tax Brackets

Irs Phone Numbers Customer Service Human Help Nerdwallet

South Carolina Department Of Revenue

Sc Dept Of Revenue Scdor Twitter

Filing South Carolina State Tax Returns Things To Know Credit Karma

Sc Dept Of Revenue Scdor Twitter

South Carolina Lawmakers Reach Deal To Cut Income Tax

Who Pays State And Local Taxes In South Carolina The Ruoff Group